Economic Impact of Russia vs Ukraine War on Bangladesh

Bangladesh is also experiencing the economic impacts of the Russia-Ukraine war. With Bangladesh, there are import and export commercial links between Russia and Ukraine. New orders were canceled due to numerous payments being prohibited and reduced shipment to Russia due to Swift's closure in Russia. The first nuclear power plant megaproject in Bangladesh also directly involves Russia. For this initiative, Russia is contributing both financial and technical support. Concerns concerning the financing have been raised in light of SWIFT and Russia's central bank sanctions.

In the fiscal year 2021–2022, the government intends to increase the gross domestic product by 7.2%. After reaching a 29-year low growth rate of 3.51 percent in FY20, the growth was 6.94 percent in FY21. The BB warned that several issues, including as unfavorable effects of the Russia-Ukraine war and rising global commodity prices, might hinder the predicted growth for the current fiscal year.

According to official figures, the country's inflation rate,

as determined by the consumer price index on a point-to-point basis, increased

to 6.71 percent in February 2022 from 5.86 percent in January. From 5.62

percent in January, the 12-month average inflation rate rose to 5.69 percent in

February.

Export

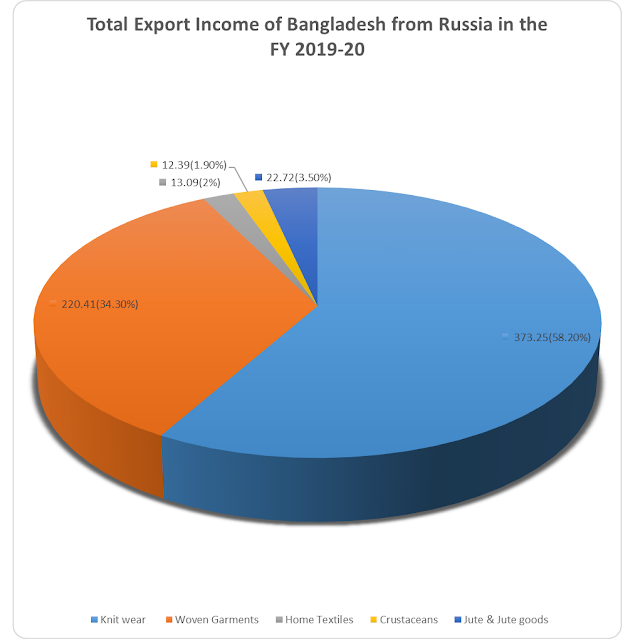

Europe is one of Bangladesh's top export destinations. The European Union region is the destination of 58% of Bangladesh's total exports. For the fiscal year 2019–20, Bangladesh's total export revenue from Russia is 1.72 percent. Over 91 percent of Bangladesh's exports to Russia were made up of RMG goods.

|

| Total export income of Bangladesh from Russia in the FY 2019-20 |

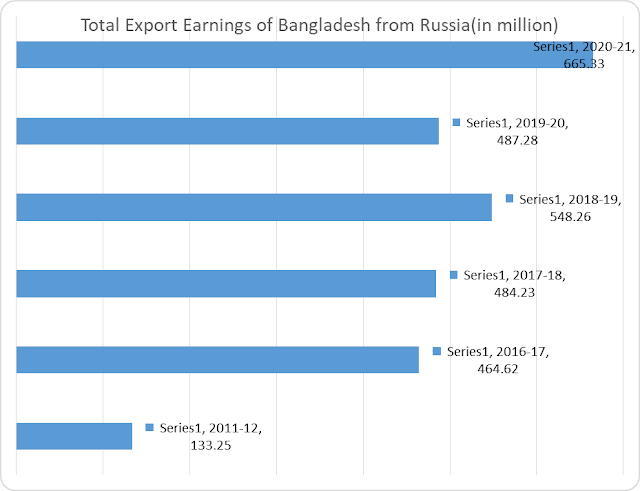

Bangladesh's exports to Russia have grown yearly for the previous ten years. Bangladesh's exports to Russia totaled more than $133 million (133.25) in the 2011–12 fiscal year and more than $665 million ten years later (665.32).

|

| Total Export Earnings of Bangladesh from Russia (in million) |

On the other hand, Bangladesh's exports to

Ukraine in the same fiscal year were more than $26 million (26.85). Whereas

more than 25% (25.51%) are veggies, around 44% (43.72) are RMG items and more

than 21% (21.45) are footwear products. Less than 2% of Bangladesh's overall

export revenues come from Russia and Ukraine combined. Bangladesh can lose out

on these export revenues if the Russia-Ukraine war persists. To

keep up with imports and exports with Russia, the Bangladesh Consulate in

Russia put up a Barter System and Government-to-Government Initiative.

Chinese Yuan accounts for 77 billion, or

13%, of Russia's total foreign exchange holdings. A multibillion-dollar

currency exchange arrangement between the two central banks will assist in

maintaining commerce between the two nations.

Bangladesh and China have a number of other

bilateral trade and financial agreements. The agreements with China can be used

to sustain commerce between Bangladesh and Russia if Russia wants to purchase

from Bangladesh. However, the United States and its western allies have already

cautioned China not to permit Russia to evade the economic sanctions they have

imposed.

The notion of selling to Russia should be

abandoned in this situation if Russia continues its assault on Ukraine. The

biggest issue will arise if Russia expands its invasion of Ukraine and if NATO

and European nations also directly confront Russia to defend Ukraine.

The conflict between Russia and Ukraine,

however, may escalate to include Europe. Bangladesh would be adversely impacted

by the conflict no matter how long it lasts since 58 percent of Bangladesh's

entire export revenue comes from EU nations.

Import

The Export Promotion Bureau estimates that Bangladesh imported a variety of items from Russia in 2020–2021, totaling $466.7 million. From Russia, Bangladesh primarily imports wheat, cooking oil, chemicals, fertilizers, steel, and aluminum, among many other goods. 81% of sunflower oil, 19% of corn, and 29% of wheat are exported from Russia and Ukraine. The cost of these goods has skyrocketed on the global market as a result of this battle.

Khandaker Golam Moazzem, research director at the Center for Policy Dialogue or CPD, said: "Transactions have become quite challenging since Swift's shutdown in Russia. Additionally, it is now challenging to acquire items from Russia because Bangladesh's shipping to Russia has also ceased". The economy of Bangladesh is negatively impacted by this. In order to get over this problem, Bangladesh must import these substitute goods from any nation. The impacts of the conflict, however, will make the problem time- and money-consuming. Because of the distance and duty fee, import costs will rise even more. Consequently, the country's economy would suffer as retail and wholesale prices for commodities would likewise rise.

Development Project

Bangladesh's first nuclear power plant is named Rooppur. One lakh thirteen thousand crores are the projected cost of the project. The BBC reports that Russia's VB Bank is lending aid for 90% of the project's overall budget. However, during the Russia-Ukraine conflict, a number of Russian banks, notably the state-run VB Bank, were expelled from Western nations. Ahsan H. Mansoor, executive director of the Policy Research Institute of Bangladesh, said: "Russia won't be able to finance Bangladesh's Rooppur nuclear power facility given the ongoing state of the war, according to the statement."

Global

Bangladesh needs 2 million tons of edible oil annually; however, it only produces 0.2 to 0.3 million tons of that amount. Therefore, the remaining 90% of the oil must be imported by Bangladesh. While a small amount of edible oil and soybean seeds are imported from Brazil and Argentina, respectively, majority of Bangladesh's oil seeds come from Russia and Ukraine. The Daily Star said that the cost of soybean oil increased from $1,460 per ton in January 2022 to $1,598 in the following month. Because of the Ukraine-Russian conflict, several nations have ceased purchasing oil from Russia. The price of oil has therefore climbed significantly on the global market.

In the meanwhile, just like every year, there will be a 3-lakh tone demand for edible oil throughout Ramadan. Due to the conflict, there is a chance that Bangladesh's edible oil price might climb more, which would be detrimental for Bangladesh's economy.

In the case of fuel, the price of crude oil on the worldwide market during the pandemic, which was just $50 a barrel, has now decreased to $139 in 2022, much like in the case of edible oil. Moreover, economists and energy experts anticipate a $200 price increase. The third-largest producer of fuel oil worldwide is Russia. Bangladesh would be affected if the price of fuel oil on the international market keeps increasing at this rate. An average of 40% of Bangladesh's total energy needs to be imported. Oil will thus cost more per liter if it is imported at higher costs. The cost of transportation and power in the nation will climb higher if oil prices rise, severely harming the national economy.

Following the declaration of a total closure of Russian aircraft in European Union airspace due to the war in Ukraine, Russia has also prohibited its airspace from 32 nations, including the European Union and Canada. In addition to increasing transportation expenses for import and export, this has increased the distance that Bangladesh must travel to import and export commodities to other Asian nations and far-off foreign countries. Because of the conflict, the economy of these nations are under pressure from the growing costs of numerous commodities, especially oil, and gas, which will lower peoples' purchasing power.

Bangladesh receives 75.73 percent of its export revenue from the United States, Canada, and the United Kingdom in addition to the EU. The country's RMG sector would suffer the greatest loss because exports from EU nations account for 64% of this industry's total export revenue. The conflict will have a significant influence on Bangladesh as well because of its worldwide effects.

Food Security

The two countries that are considered "the breadbasket of Europe," Ukraine and Russia, are the main exporters of staple goods. Around one-fourth of wheat, more than three-quarters of sunflower oil, and one-sixth of corn are exported by both nations.

There will be repercussions from the battle, creating "cascading danger." The crisis in Ukraine has already shocked Bangladesh's commodities market. Bangladesh buys soybean oil mostly from the United States, Brazil, and Canada, however, a disturbance in the supply chain on the global market has resulted in a price increase for the commodity. Bangladesh mostly imports wheat from the Black Sea region, which caused a sharp increase in the cost of wheat flour. According to the Observatory of Economic Complexity, more over half of the wheat was imported (OEC).

As an illustration, Bangladesh bought wheat worth $1.28 billion in 2020, making up 2.65% of all imported goods. Russia (31.8%) and Ukraine (23%) accounted for the largest percentage of imports, at $409 million and $295 million, respectively. Bangladesh also imports 44% of its supply of corn and soybeans, and those commodities are also seeing rising global prices (calculation based on FAOSTAT food balance sheet). Bangladesh's feed business is suffering, which raises the cost of producing goods manufactured from poultry, beef, and fish—industries already severely affected by the epidemic.

Bangladesh's agriculture, particularly rice production, depends heavily on the use of fertilizers. More than 1.2 million tons of fertilizer are imported by Bangladesh annually, including 31% of its needs for nitrogen, 57% of its needs for phosphate, and 95% of its needs for potash. Around 286 kg/hectare are applied on average. These markets have been affected by the conflict, which targets Russia with export restrictions. Belarus and Russia are two of the world's top manufacturers of fertilizer. Belarus (75%) and Russia (34%) provide the majority of Bangladesh's potash imports (41 percent). Bangladesh will probably have to pay more to buy these parts from other countries.

Decreased input use, especially with regard to nitrogen-based fertilizers, could result in lower rice production and higher demand for imported rice. Bangladesh's economy is already feeling the economic impact of the Russia-Ukraine war due to its dependency on imports, which could result in a food crisis there.

Power Sector

Up until last week, the year's power supply status appeared to be excellent as the entire supply of gas, oil, hydro, coal, and imported electricity was extremely near to the demand. The previous several days have seen widespread, severe power outages due to a decline in oil-based power generation as a result of a fuel supply deficit. Although Bangladesh has the power generation and supply capacity to satisfy the demand, transport workers have not been transporting diesel and heavy fuel oil to the plants, which caused power generation to decline by 500–700 megawatts, resulting in load shedding.

The PDB estimates that the daily power consumption is currently 8,300 MW, with natural gas accounting for more than 60% of this affordable and environmentally friendly energy. A thousand megawatts or more is often the difference between morning and nighttime power use. The disparity has since been reduced to about 300 and 400MW.

Due to the government's rapid installation of leased power plants, oil-based electricity generation has surged since 2010. For the gas-based power plants to operate at full capacity, the nation's gas production is insufficient. Due to a severe gas shortage that has significantly reduced power output, the load-shedding of electricity across the country has been increasing.

On Sunday, July 3, 2022, 1,500 MW of load-shedding was required, despite a 1,273 MW power outage being predicted, according to official statistics from the Bangladesh Power Development Board (BPDB), as reported by the UNB agency.

At sunset on Sunday, the nation's greatest power output was 12,115 MW, compared to a demand for 13,615 MW. This difference between the peak demand and power generation was 1,500 MW. The BPDB official said that load shedding was masking the cap.

Officials from BPDB blamed a scarcity of gas for the decline in electricity production. Because of a gas supply deficit to their power facilities, they said they must halt the production of 3650 MW of energy. The Russia-Ukraine war, as acknowledged by the government, is the primary cause of the increase in gas prices. The government further asserted that the Russia-Ukraine war's economic impact on energy prices on the global market has caused us to face similar difficulties as other nations.

The government opted not to purchase liquefied natural gas from the international spot market due to an outrageous price increase, according to state-owned Petro Bangla officials, which emphasized a drop in the nation's gas supply and output.

Gas is used to create 52% of the country's energy, according to data from the Bangladesh Electricity Development Board (BPDB). The government's decision to temporarily avoid purchasing LNG on the international spot market in light of the fuel's growing price has resulted in less LNG being injected into the nation's gas supply system, according to data from Petrobangla. When the government last bought LNG on the spot market in May, the price per Metric Million British Thermal Unit was USD 26. For every metric million British thermal units, it cost now 36 USD. As a result, the local gas supply, which was previously at 2,822 million cubic feet per day, is now 700 mmcfd short (mmcfd).

On June 29, the national gas system received at least 854 mmcfd (million cubic feet per day) of LNG. Petrobangla records show that on July 4, that number had decreased to 507 mmcfd. The nation's trade imbalance increased to $18.7 billion in the first seven months of FY22 from $10.27 billion in the same period the year before. The country's foreign exchange reserve decreased as a result by more than $4 billion over the course of seven months.